Policies & Practices

P&G’s Approach to Tax

P&G is focused on meeting consumer needs everywhere we do business, while creating value for our shareholders and continuing to be a good corporate citizen. Corporate responsibility is the foundation for all P&G's Citizenship efforts. Sustainable tax policy and a transparent approach to tax are important elements of corporate responsibility.

Learn the details — view or download P&G’s Approach to Tax, here:

Our Purpose, Values and Principles (PVPs) guide our approach to all taxes across the globe.

Our Purpose, Values and Principles (PVPs) guide our approach to all taxes across the globe.

We seek tax certainty to achieve predictable and sustainable financial outcomes that positively impact all stakeholders.

We seek tax certainty to achieve predictable and sustainable financial outcomes that positively impact all stakeholders.

We are recognized as a transparent and low-risk taxpayer and do not pursue aggressive tax planning.

We are recognized as a transparent and low-risk taxpayer and do not pursue aggressive tax planning.

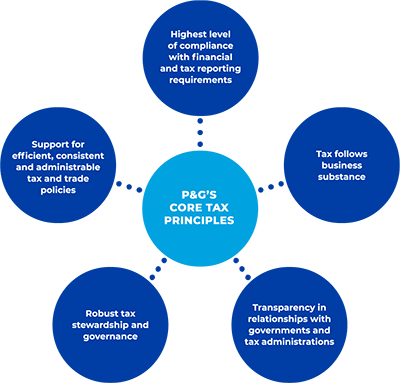

Our Core Tax Principles

Our Core Tax Principles are the foundation of our approach to taxes globally.

P&G wants to be known, through words and concrete actions, as a company that is responsibly governed, behaves ethically, and is open and transparent with governments in our tax affairs.

Total Tax Contribution

Our Total Tax Contribution is comprised of approximately $6.1 billion of taxes directly borne by P&G and approximately $4.6 billion of taxes collected by P&G and remitted to governments. Our taxes borne include $4.3 billion of corporate income taxes paid by P&G.

We regard this publication as complying with the requirement of Schedule 19, Finance Act 2016 for the financial year ending 30 June 2025.